The Australian housing market has been attracting many homeowners and investors. Over the years, the market has seen its fair share of growth and changes.

The dynamic rental market and immigration pattern have gathered the eyes of a lot of investors. These factors shape the landscape of the Australian property market.

However, the recent pandemic and the ongoing recession raise the question: Is the Australian housing market going to crash anytime soon? Stay with us until the end to find out all about it.

Analysis of Past Housing Market Crashes in Australia

The Australian housing market has experienced downturns throughout its history. The crashes of the 1980s and 1990s highlight the market’s vulnerability to economic fluctuations.

A combination of economic factors marked the recession of the 1990s. It includes structural reforms, currency fluctuations due to the floating of the Australian dollar, and a boom-bust cycle in construction.

However, the housing market has not seen any crashes in over 30 years, although things have been quite tough due to the global recession.

What is the present scenario of the Australian Housing Market?

Since the pandemic, the market has become quite unstable. In the last couple of years, the market trajectory was not showing promising signs.

However, the recent data from CoreLogic shows resilience and positivity in the Australian housing market. The pace of housing market growth increased from 1.4% to 1.6% in the first quarter of 2024.

The interest cut is another piece of news this year. The Commonwealth Bank has predicted that there will be a 6% cut in the interest starting from September of this year.

National property prices are rising and yielding a high return on investment. However, that cannot be said for different regional areas.

Don't Settle for Less—Build Excellence with Dhursan

Market Analysis — Capital Cities

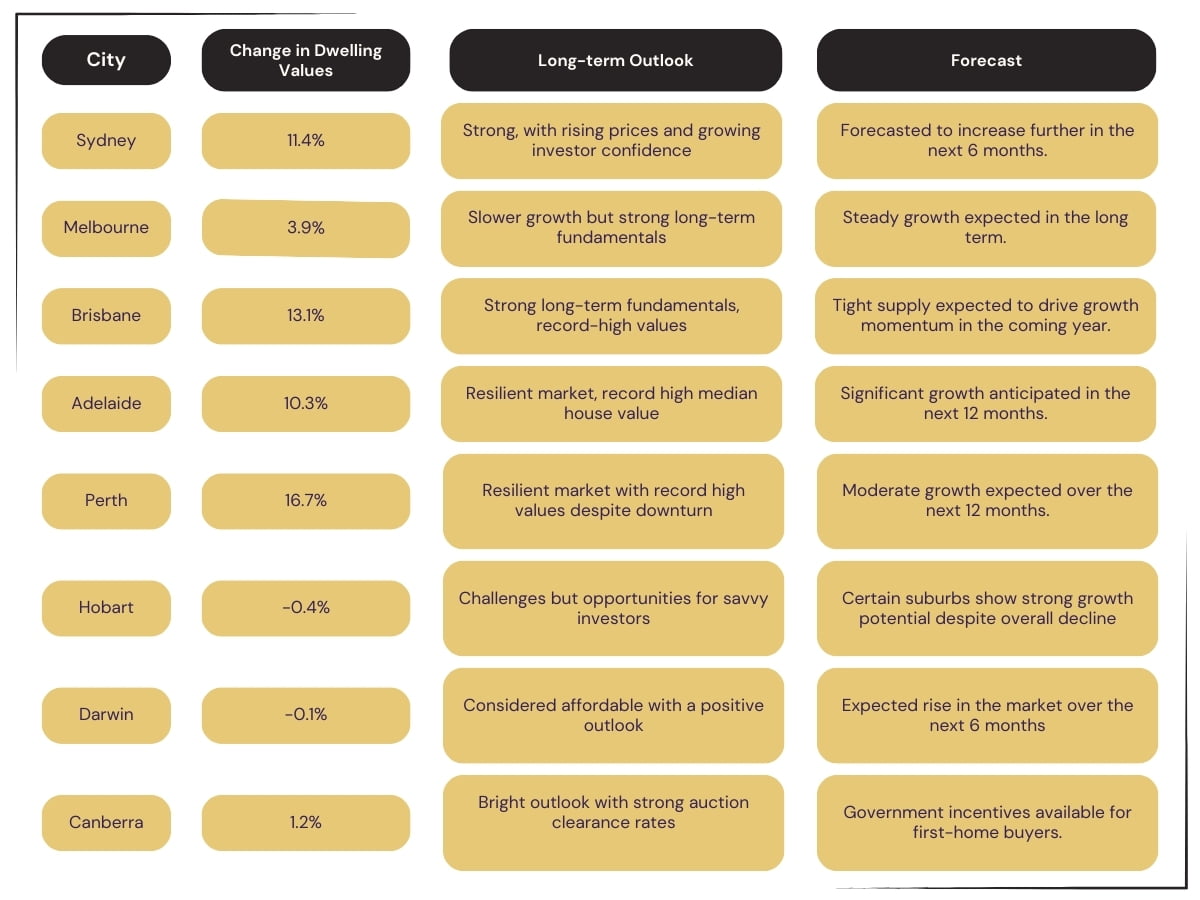

Property value is increasing at the national level, but that may not be the case for all regional property markets. The price of city housing has been increasing or decreasing. Let us find out.

Sydney Property Market

It is one of the most thriving property markets in Sydney. Recent values have increased by 11.4%, attracting many investors. Plus, it is expected to increase further in the next six months,

Melbourne Property Market

Another thriving capital city is Melbourne. The property market has dwelling values that have increased to 3.9%. There is slower growth compared to other cities, but long-term fundamentals are strong.

Brisbane Property Market

The Brisbane property market also has a high potential for new house buyers. In recent years, there has been an increase of 13.1%. Long-term fundamentals remain strong, with record-high dwelling values. There are low listings that suggest tight supply and expected growth momentum in the coming year.

Adelaide Property Market

Adelaide is a growing capital city in Australia, with a stunning growth of 10.3% in the property market. Market resilient to price falls; record high median house value. Expected to see significant growth in the next 12 months

Perth Property Market

The change in dwelling values in the Perth housing market over the past 12 months was 16.7%. It has set record high dwelling values and is a resilient market despite the downturn in 2024. It is expected to experience moderate growth over the next 12 months.

Hobart Property Market

The Hobart housing market has shown a negative growth of -0.4%. There have been challenges in recent months, but there are opportunities for savvy investors. Certain suburbs show strong growth potential despite the overall decline.

Darwin Property Market:

Similar to Hobart, Darwin’s dwelling values are forecasted to be around -0.1%. It is considered Australia’s most affordable capital city. However, with the expected rise in the market, there is a positive outlook for the next six months.

Canberra Property Market

Canberra’s house prices have increased by 1.2% over the past year. There is a bright outlook for the next six months, with strong auction clearance rates. Government incentives are available for first-home buyers.

Explore our latest home designs tailored for the modern homeowner. View designs now!

Will Australian house prices keep rising?

Many investors and first-home buyers have assumed that Australian property prices may increase. The good news is that prices are lowering as the market is in the recovery phase.

The market is still recovering due to decreasing inflation and expected interest rate peaks, which are attracting more buyers and sellers.

The strategic investor or home buyers may find this the perfect time for real estate investment.

Take the opportunity of this time and invest in real estate. Dhursan construction is your trusted partner for the real estate investment.

What Could Cause The Australian Property Market To Crash in 2024?

The exponential growth of house prices has sparked concern about a market crash. However, the Australian property market has not experienced a crash for over 30 years.

But there are some factors that can cause the crash of the residential market. Understanding these factors can prepare investors to deal with the future of the market ahead.

Economic downturn

During the initial stages of the COVID-19 pandemic, the Australian government introduced various initiatives to support the residential industry. Such as the First Home Loan Deposit Scheme and HomeBuilder grant to temporarily boost housing demand.

However, the inflation rate reached 4.1% in the first quarter of 2024, hiking the mortgage rate and making it difficult to afford a house.

These fluctuations in the property market, characterized by ups and downs, signal a potential market crash in the near future.

Higher Interest Rate

Australian citizen keeps housing as their primary goal of life. The 30-40% of household income goes towards the mortgage payment.

With global inflation, interest rates are increasing. Reserve Bank of Australia has hiked the interest rate by 0.75%, with the average 30-year fixed mortgage rate rising to 6.28%.

The higher rate means more mortgage payments, which constrains the power of consumer spending.

The amazing thing about Australian people is that they are good with their money. Based on past experience, there’s a chance that this could actually lead to more money available for households based on past expenses. This might mean about 5% more cash in hand compared to their income.

Transform Your Vision into Reality with Dhursan Construction

Over-valuation of the property market

Sometimes, the price growth of property goes beyond its intrinsic worth. The overvaluation happens due to limited supply and better affordability for investors. It has both positive and negative effects on the housing market.

It drastically increases property prices, which is a positive outcome for homeowners. On the other hand, it also increases household debt, which hinders economic growth in the long run.

External Factors

Geopolitical tension and the global economic slowdown affect economic instability. They decrease individuals’ purchasing power, lowering demand in the property market.

Similarly, the change in immigration patterns has hiked the demand for housing. Unlimited demand and limited supply cause a surplus of property value.

While these factors are difficult to predict individually, they can combine to have a major impact on the residential market.

Conclusion

The Australian property market has shown remarkable growth during the pandemic, but the increasing interest rate has impacted it.

The prediction of a property market crash may scare home buyers and investors. However, the market is resilient, and this may be the correct opportunity for real estate investment.

Just be patient and keep on getting updates on what is going on in the market for strategic investment.